SR22 Texas Insurance Instant Quotes

Everything about SR22 Texas INSURANCE. What it is, who needs it, best and cheap SR22 Insurance Texas quotes, Companies, comparisons, what does it cover, how it works, coverage for SR22 in Texas State, how to get SR22 car insurance, renewal and/or expiration… and much more. Simply everything about:

What you should know first:

SR-22 auto insurance coverage is considered “high-risk” insurance coverage and not all of the Texas car insurance companies provide SR 22 protection. Not all insurance providers are qualified to handle SR 22 filings in each and every state, so it’s important to use a trusted consultant, while researching and comparing companies on the web. Using a local agent is extremely important.

What is an SR22 Texas Insurance?

The majority of people assume that an SR22 car insurance policy is important only when somebody is convicted of a DUI – Driving Under the Influence or DWI – Driving While Intoxicated. However, there are numerous additional causes that cause person to be required to purchase an SR22.

SR-22 is not a kind of vehicle insurance coverage. It is just a document requested through the Department of Motor Vehicles (DMV). I must filled out, certified and filed by using a licensed motor vehicle insurance company.

Whenever your driver’s license is suspended for almost any reason and SR22 filing is necessary. It is a official certification by your insurance coverage company that you will maintain continuous motor vehicle coverage. In the event your license was suspended, you may be requested to file an SR-22.

Without SR22 insurance coverage, you risk losing your driving privileges.

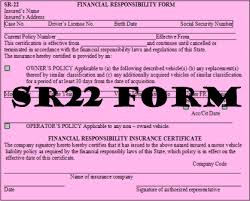

The SR22 Form for SR22 Insurance Texas

Available Insurance Policy Companies

(SR22 Texas)

Don’t Drink and Drive. Receiving a DWI could imply incarceration and the end of your driving license if don’t know the tactics for limiting the fees and penalties. A single instance of drunk or intoxicated driving may well leave you stuck with extremely high legal expenses, court-imposed restrictions, along with a department of motor vehicles probationary status for almost 3 years.

In the event you do receive a DWI, we can help.

Austin Insurance Group’s extensive auto insurance providers give you rapid access for the lowest priced rates. SR22 filing doesn’t have to cost you more. Let us help you find the best plan at the lowest rates.

How Much Is SR22 Texas Insurance?

There’s not one answer to this question. The cost all relates to:

- which State you reside

- what zip code you live in

- how many violations you have

- your age

- other available discounts

This is why the best action you can take is to request a price quote online or by phone from a trusted agent. Call to review and verify the quotes to find the best plan of your needs.

Considering that Texas SR22 insurance coverage is simply an SR22 form filed proving you have insurance, the true cost is really based on you and your driving habits. When you no longer need to file the SR22, simply remove the filing from your policy. But DO NOT cancel your insurance, or you could be at risk to start this process all over again.

Call your trusted agent, Austin Insurance Group today with additional questions and find out how to get a new policy started. 512-339-2901

Thank you and drive safe!